Institutions of higher education continue to enhance their capacity to develop and evaluate strategies for promoting college access and success. Recent studies from Texas and the University of Michigan are prominent examples of how institutional data can be leveraged to better understand how financial aid policies improve college attainment for low-income students. However, financial aid data use is uneven across institutional contexts. A major barrier is the lack of coherent federal policy governing how information generated from the financial aid process can be used to understand how aid and economic factors impact college completion and student success outcomes. This blog post provides an overview of these issues and considers the state’s role in developing effective models for financial aid data use.

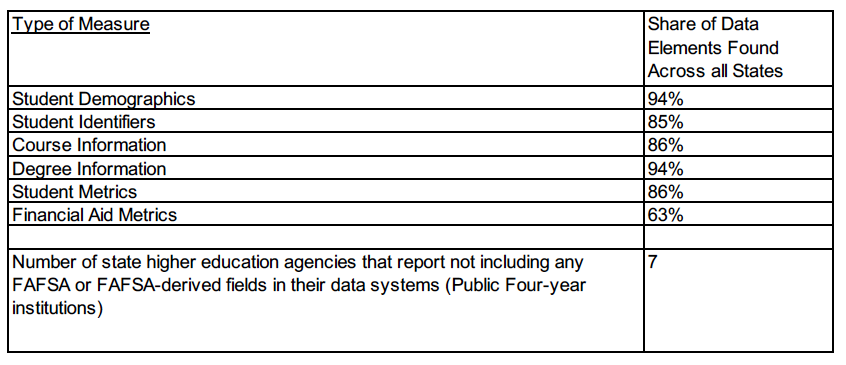

As demonstrated in SHEEO’s most recent Strong Foundations survey (and briefly summarized in the table below), coverage of financial aid metrics in state data systems is relatively lower and varies more across states than other types of student data. Fewer states and systems report tracking their students’ student-debt loads as compared to tracking workforce data on postgraduate earnings, which are much newer and are typically sourced externally from state workforce agencies. National survey data from institutional research offices paint a similar picture. A majority of these units reported having limited or no access to financial aid data and limited involvement in studies involving student financial aid modeling or student debt.

| Coverage of Student Data Elements Collected in State Data Systems (Public Four-year Institutions) |

These findings are incongruent with the well-deserved focus on college affordability in state and federal policy discussions today. Many states and colleges are developing programs and strategies to address financial barriers in order to promote better and more equitable student outcomes. Evaluating information about students’ ability to pay for college and the effectiveness of aid programs in addressing these challenges should be part of that solution. However, prevailing interpretations of federal law suggest that institutions’ limited use of financial aid data is actually by design. Uncertainty about allowable use cases involving identifiable financial aid data limits their integration with other student data streams and their use in evidence-based decision-making.

Federal Financial Aid Data Use Policy

While the data use framework established under the Family Educational Rights and Privacy Act (FERPA) applies to financial aid data, other laws further restrict the use of data collected as part of students’ participation in federal financial aid. Most importantly, the last reauthorization of the Higher Education Act (HEA) in 2008 added a provision that data collected on the FAFSA could only be used “for the application, award, and administration of aid” with the goal of protecting student privacy. Three years later, the U.S. Department of Education (ED) regulated explicit research and evaluation exemptions in FERPA, but the HEA use restrictions were not considered at that time. While the HEA signals elevated privacy protections for FAFSA data, whether and how the HEA restrictions should apply to institutional research activities and program evaluation remains unresolved over a decade later.

After increasing calls from the field for clarity, in 2017, ED’s Privacy Technical Assistance Center (PTAC) issued FAQ guidance. ED’s guidance promotes an expansive regulatory interpretation of the HEA provision in two critical ways that, intentionally or not, effectively close off most uses of identified institutional financial aid data. First, award information derived from the FAFSA is also considered “FAFSA data.” This makes virtually all student-level financial aid data elements subject to the HEA use restrictions, including measures like Pell eligibility, a common proxy for identifying lower-income students, as well as state and institutional aid awards information that is derived from the FAFSA. Second, institutions may only conduct evaluations and analyses that are “necessary to the efficient and effective administration of student aid.” While the boundaries of such activities are not explicitly addressed by the PTAC guidance, they have been further interpreted by the National Association of Student Financial Aid Administrators (NASFAA) as potentially excluding activities that use student financial aid data to gauge the effectiveness of financial aid programs aimed at increasing completion rates and addressing equity gaps.

This has created challenges for institutions in their routine uses of financial aid information as well as for those seeking to use the data more intentionally to serve students. Specific examples of the negative impact of the non-regulatory guidance on campus and system operations were outlined in a letter to ED leadership last fall. It has also thrown into question their inclusion in statewide and systemwide data systems, even though previous PTAC guidance affirmed such sharing and uses to support data-driven decision-making. Even processes necessary for compliance with state and federal mandates are being disrupted, such as reporting to the federal Integrated Postsecondary Data System (IPEDS) and federal grant reporting. These dynamics may also have a chilling effect on data sharing for educational research involving university-based and external faculty, like the examples from Texas and Michigan shared above.

Despite the potentially far-reaching regulatory impact of this guidance, it was issued informally and not widely publicized. This is something the Government Accountability Office (GAO) has raised concerns about in the area of student privacy policy. These issues are complex and require more consultation with the field to ensure that data uses in support of educational programs are not adversely impacted.

For those who work in and around higher education research and policy who are either a) totally unaware of these issues or b) confronting barriers in this area seemingly out of the blue, you are in good company. But if the goals of effective data use policy are to protect student privacy and to balance those interests with promoting legitimate research activities for institutional improvement, the status quo does neither particularly well.

Visioning a Student-Centered Approach to Financial Aid Data Use: A Role for States

While well-intentioned, the current state of financial aid data use policy is problematic for students and the institutions and states that serve them. Safeguarding the privacy and confidentiality of student and parent data in the financial aid process is an important policy goal and should not be diminished, especially given the compulsory nature and the sensitivity of financial data collected by the FAFSA. But restricting states and institutions from most uses of financial aid data neglects the key role that states play in financing higher education, as well as the realities that many states, colleges, and students face in financing college costs. It also undermines goals of institutional accountability, transparency, and the accuracy of external reporting, including to the federal government through IPEDS. The federal government now collects outcomes data on programs like the Pell Grant and Stafford Loan Programs and its interest in these data are tied to Title IV, but high aid states like California are investing even more in lower-income students. States and institutions have a compelling interest in these data and are in a better position to connect the dots. This reality should be reflected in federal law and policy as part of a more student-centered approach to financial aid data use.

In conjunction with other stakeholders, state systems and SHEEOs are well positioned to negotiate these trade-offs and provide leadership in building a more student-centered vision for financial aid data use. As stewards of longitudinal and linked data systems and the primary organizational connection between public colleges and state and federal policy, they are a logical place to operationalize models for responsible data use to address some of the pressing challenges related to college access and affordability in their states.

Matthew Case is Assistant Director for Policy Analytics with the California State University, Office of the Chancellor. The opinions expressed in this blog are those of the author and do not necessarily reflect the official policy or position of the California State University, the State Higher Education Executive Officers Association, or any other organization.